Transformers and More @ The Seibertron Store

Discuss This Topic · Permanent Link

Views: 56,352

More villains in MPM line? (MPM-1 Starscream already present, but..)

Would love to do that, more MP figures to talk about later in the year, but we do want to balance out the factions.

Difference between MPM and Studio Series, in terms of character selection in particular?

Global accessibility with Studio Series so as many as possible, MPM is more selective by its nature. Trying to catch a new generation of grown kids too. Attempt to create entirely new toys for this demographic, and have fun with the line later down the road.

Bumblebee movie shift affecting the line?

Not in release (April 2018), they were supposed to come out together but only some characters have been moved later to coincide with June release. Studio Series collection will host the movie line, but not intended as a catch-all (Thundercracker an exception). Robot modes are scale-accurate, fit a collector shelf, cautious about the numbering system, a narrative woven into it, including backgrounds and cut-outs.

Future of Generations?

Power of the Primes ends in 2018. War for Cybertron starting in January 2019, no reveal of the new fiction yet so plenty of speculation welcome.

Why another trilogy?

It helps and invites new fans into the franchise, casual fans and kids. Trilogy invites to speculate, not lead to an ecosystem – it’s a storytelling universe, as per Hasbro blueprint.

Comments on unification of Takara Tomy and Hasbro?

The relationship and cooperation has always been there, this just allows for bringing multiple fandom factions – allowing things like Movie Masterpiece and Takara Tomy Masterpiece lines to be accessible to everyone. Cooperation is key, and building on the passions of both teams, in a very genuine way.

Any plans to move away from stickers, or get better?

We hear the concern, but stickers will continue in Prime Wars. Next chapter will be approached with fan feedback in mind – though cannot reveal yet. War for Cybertron is a new take on things, moving a little further away from the callbacks and throwbacks in POTP too, though story can feel a little more familiar.

Masterpiece continuing after the MPM line?

Looking at more Decepticons.

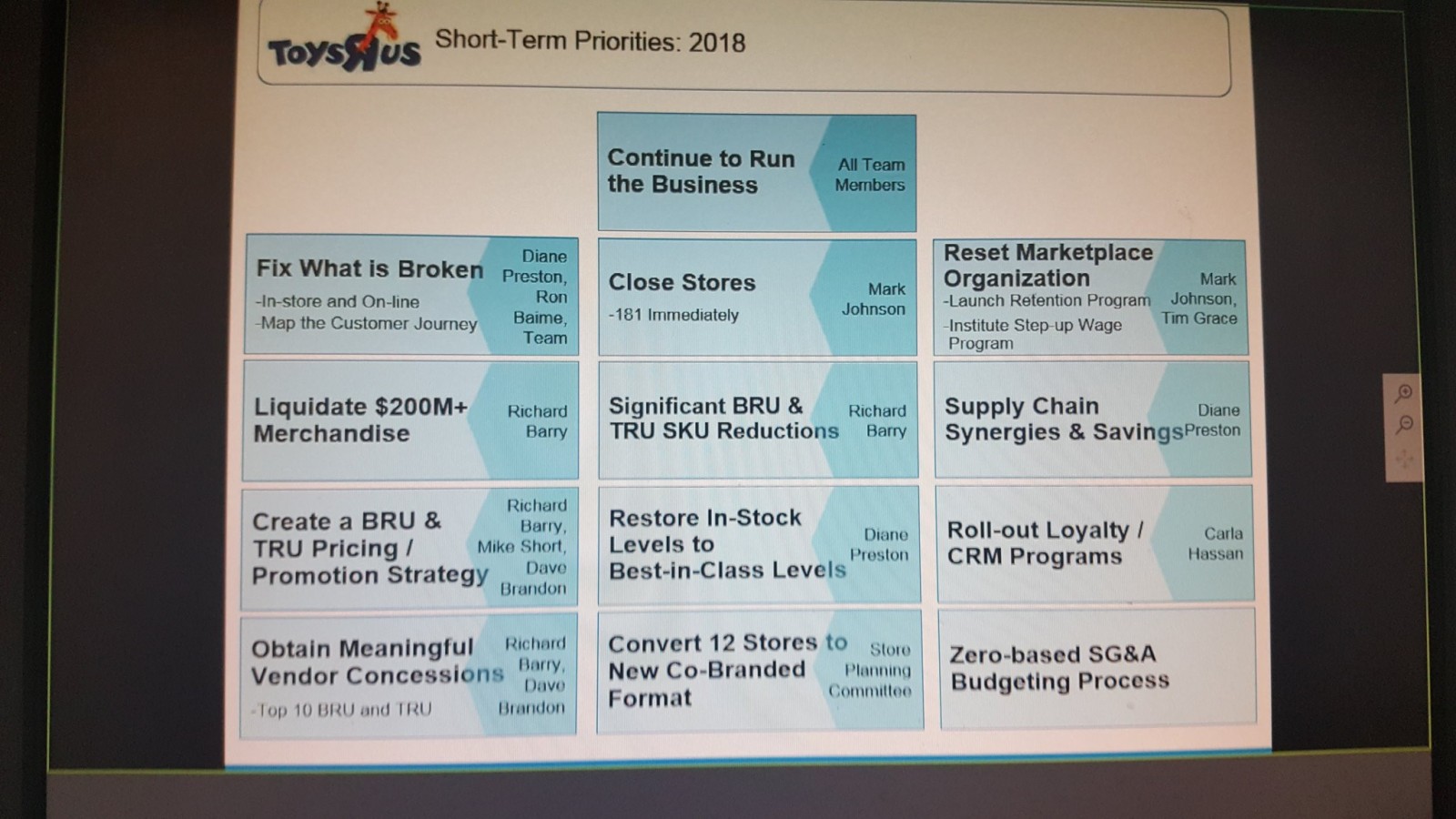

How is Toys R Us situation affecting Hasbro Transformers?

Not much of a comment, though Studio Series Thundercracker is a TRU exclusive. We hope to continue partnership.

Fan-vote: is there an IDW influence, and what is the Hasbro-IDW relationship continuing?

Fans are voting on a pair, not on singles. Yes, the pairings are inspired by elements of IDW, but each can fill in blanks in the toyline in different ways, that those guys can fill them. Fans have a way of organically to play and work in the battleground story. There is intentional conversations, pairings have love/hate elements, and may jar with some.

We are wrapping up current IDW continuities this year, Unicron is coming to devour everybody. The intention is to continue after that, whatever comes next. Towards end of year we should know more, but we will collaborate on more stories.

Do pairings have a gimmick? Are they new molds?

No. War for Cybertron line may include some previous molds, but intention is to give good representation of the characters. Fans are just voting on the idea of which character will best fit a toy.

(TLK Hot Rod, TR Scourge and Highbrow are examples of Partial Tool – technical shorthand klaxon – good deal of model making involved, plans are thought out strategically, already working on War for Cybertron.)

How are changes with movie plans (alleged reboot of film franchise) affecting toyline?

We’re always part of the conversation as partners, but we’re focusing on Bumblebee right now. Lots of toy concepts, lots of Cyberverse, Studio Series, War for Cybertron – we’re just pausing on the movieverse, in no way distracting us.

Bumblebee film will hopefully show what we can do collectively.

Any bets with Star Wars team on who will do best?

Hoping on parents bringing kids to the movies, that’s all. Travis Knight did grow up with G1 like I did [John Warden], so we’re expecting a new fan experience.

Cyberverse: hard G1 inspiration reason rather than RID? Female Decepticon make its way in other aspects of the brand?

Definitely yes on the latter, Shadow Striker in the series. Aesthetic is aimed to engage all generations, for robot mode at least, a currently fragmented fandom interest (BW, G1, etc) – unification of brand, of lines, of generations of fans. Opening up a dialogue and viewership, which is definitely not a G1 story, it starts in current day but there is an element of comfort for parents and older fans.

A lot of families in fan community, it’s exciting to bring them to the brand and share with kids, nieces, nephews. That doesn’t detract from Generations, War for Cybertron appealing more to the older fans and collectors.

Authentics will continue, they’re not tied to any story or fiction – just classic characters for a casual shopper, grandma buying ‘an Optimus’ or you just want ‘a Megatron’.

Exclusives?

Only TRU Thundercracker announced for now, but we do have more lined up for the year.

Would fans want to see a crowdfunded HasLab Unicron? What kind of pricing? Point fans to HasLab, talk about it, read about it, podcast about it. Talk about what you want to see, we’re listening. #Unicron

Discuss This Topic · Permanent Link

Views: 28,600

Discuss This Topic · Permanent Link

Views: 116,226

Discuss This Topic · Permanent Link

Views: 16,772

Discuss This Topic · Permanent Link

Views: 21,821

Look, I view it through the lens of the fact that we saw challenges in Europe and we saw challenges particularly in the U.K. that's a major market for properties like STAR WARS. So, I would say that clearly both the paid marketing and earned marketing, the fans in the U.S. really helped to deliver a strong box office here, it also delivered a very strong box office, globally.

But in terms of the retail takeaway and sell-in, was lower in particularly outsized impact in places like Europe and in our international market, just represent more of the line share, the decline in percentage terms. And that's what we've seen.

So, right. It's a great global property. But by contrast, just to give you an example; TRANSFORMERS international business was incredibly strong; the U.S. business was strong; the brand overall was strong.

Our team has built a plan for the right sizing of the Toys "R" Us business.

We have continued to grow the number of doors and continued to grow our revenues outside of Toys "R" Us. We continue to be supportive of them but most importantly we continue to manage our risk and inventory as they streamline the amount of inventory they can take. And we are prepared for any eventuality.

No. look, if you look at TRANSFORMERS, I think that we go from strength-to-strength. This year, TRANSFORMERS in the fourth quarter was in dollar terms, our biggest growing brand. And overall for the year grew very strong double-digits. It's because we are perpetually engaged with our audience by demographic and psychographic.

We have a preschool RESCUE BOTS show, we have our Cyberverse focused on our core kid six-to-nine year-old. We continue to run more adult oriented content on Machinima for that fan. Fan business is growing in a very significant manner. And then of course we have our movies. It was a movie year but our products were about the movie but also about all these other dimensions of TRANSFORMERS.

So, this is a brand that's working everywhere globally, it's a brand that's exceedingly strong and getting stronger in China. We'll talk more at Toy Fair about the major global initiatives and in gaming and how this brand comes to life. So, when we talk about our Bumblebee movie, it's really the focal point of an entire blueprint activation that will take place around that time of year.

And we will bring to bear all of the different strengths and power inside the blueprint to bring Bumblebee and TRANSFORMERS to life at that time. So, we know that there is an amazing array of entertainment with the beneficiaries of a lot of that that's in the world today and we think our brand like Bumblebee and TRANSFORMERS holds its own.

Discuss This Topic · Permanent Link

Views: 21,562

Board of Directors Increases Quarterly Dividend 11%, or $0.06 per share, to $0.63 per share

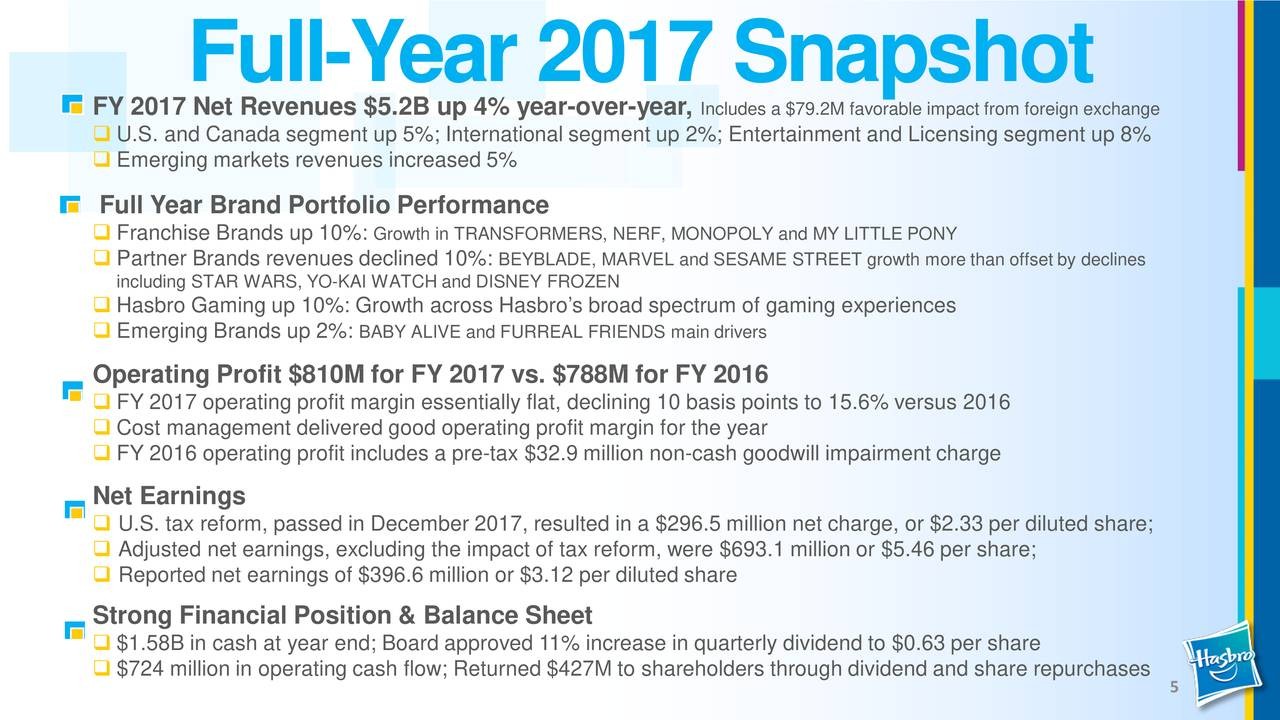

Full-Year 2017

2017 full-year net revenues of $5.21 billion increased 4%, including a favorable $79.2 million impact of foreign exchange; Operating profit margin of 15.6%;

2017 revenues grew in all major operating segments: 5% in the U.S. and Canada segment; 2% in the International segment; and 8% in the Entertainment and Licensing segment;

Franchise Brand revenues increased 10%; Hasbro Gaming revenues up 10%; Emerging Brands grew 2%; Partner Brands declined 10%;

U.S. tax reform, passed in December 2017, resulted in a $296.5 million net charge, or $2.33 per diluted share;

Adjusted net earnings, excluding the impact of U.S. tax reform, were $693.1 million or $5.46 per diluted share; Reported net earnings of $396.6 million or $3.12 per diluted share;

$724.4 million in operating cash flow generated during the year; Year-end cash and cash equivalents of $1.58 billion;

Company returned $427.0 million to shareholders in 2017; $277.0 million in dividends and $150.0 million in share repurchases.

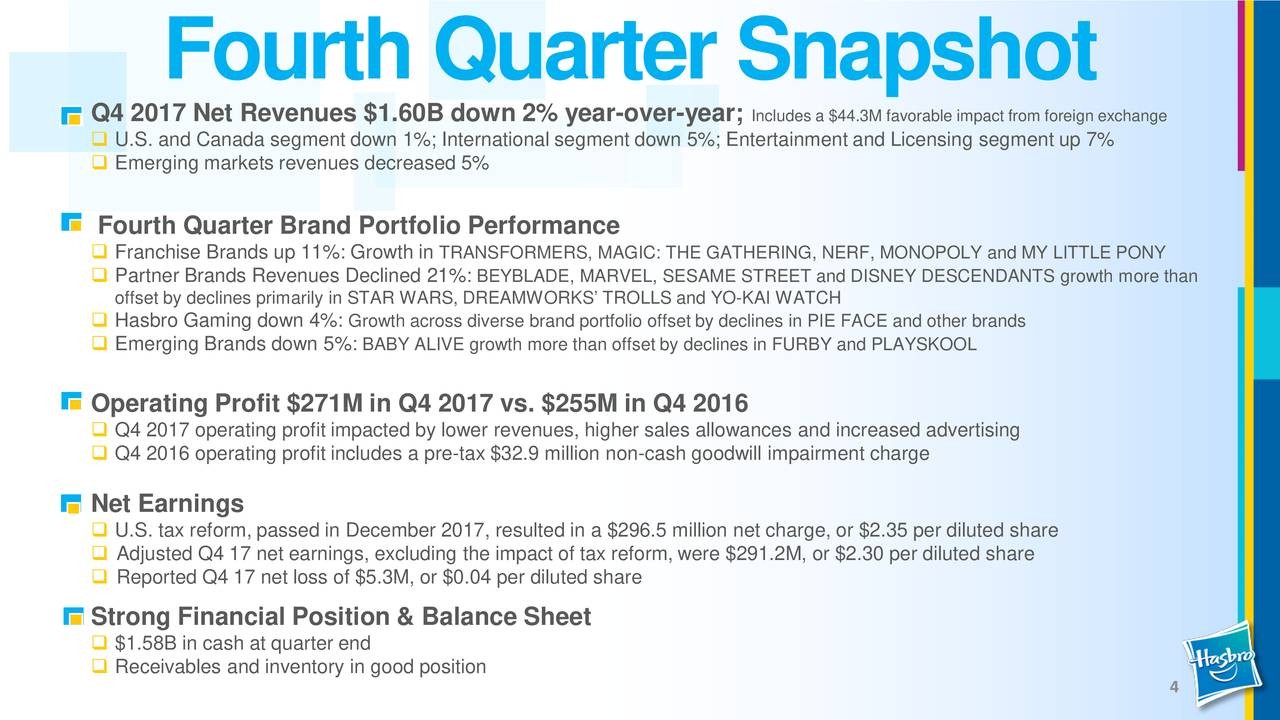

Fourth Quarter 2017

Fourth Quarter net revenues decreased 2% to $1.60 billion, including a favorable $44.3 million impact of foreign exchange; Operating profit margin of 17.0%;

U.S. tax reform resulted in a $296.5 million net charge, or $2.35 per diluted share;

Adjusted net earnings, excluding the impact of U.S. tax reform, were $291.2 million or $2.30 per diluted share; Reported net loss of $5.3 million, or $0.04 per diluted share;

PAWTUCKET, R.I.--(BUSINESS WIRE)--Feb. 7, 2018-- Hasbro, Inc. (NASDAQ: HAS) today reported financial results for the full-year and fourth quarter 2017. Net revenues for the full-year 2017 increased 4% to $5.21 billion versus $5.02 billion in 2016. 2017 net revenues include a favorable $79.2 million impact from foreign exchange.

As reported net earnings for the full-year 2017 of $396.6 million, or $3.12 per diluted share, compared to $551.4 million, or $4.34 per diluted share in 2016. Adjusted 2017 net earnings were $693.1 million, or $5.46 per diluted share, excluding a $296.5 million, or $2.33 per diluted share, impact from U.S. tax reform. Adjusted net earnings for the full-year 2016 were $566.1 million, or $4.46 per diluted share, excluding a post-tax $14.7 million, or $0.12 per diluted share, non-cash fourth quarter 2016 goodwill impairment charge related to Backflip Studios.

In December 2017, the U.S. enacted the Tax Cuts and Jobs Act that provided significant changes to the U.S. tax code, including a one-time repatriation tax payable over eight years. As a result of the Act, the Company recognized a net charge of $296.5 million. Given the significant complexities associated with the changes in the U.S. tax code, the estimated financial impact for the fourth-quarter and full year 2017 are provisional and subject to further analysis which could result in changes to this estimate during 2018 as further guidance is issued.

2017 net earnings also include a $0.25 per diluted share benefit versus full-year 2016 from the adoption of FASB ASU No. 2016-09, Improvements to Employee Share-Based Payment Accounting.

“Hasbro’s global team’s execution of our Brand Blueprint drove revenue gains in Franchise Brands, Hasbro Gaming and Emerging Brands, including immersive brand experiences across consumer products and digital gaming,” said Brian Goldner, Hasbro’s chairman and chief executive officer. “Our strong performance ranked Hasbro #1 across the G11 markets for the full-year 20171. In the fourth quarter, Hasbro Franchise Brand revenues increased 11%. However, overall consumer demand slowed in November and December both for the industry and for Hasbro. A decline in Partner Brands and Europe revenues resulted in us not meeting our fourth quarter revenue expectations. Looking ahead, our innovative lines are supported by robust storytelling and digital initiatives that position us well for 2018 and beyond.”

“Over the past five years, we added over $1 billion in revenues to our top line, growing revenues four consecutive years, while meaningfully increasing operating profit, net earnings and generating significant cash flow,” said Deborah Thomas, Hasbro’s chief financial officer. “Hasbro is in a strong financial position with the cash and profitability to invest in growing our business for the long term. Our team’s excellent job of understanding and assessing the global tax environment and managing associated risks contributed to strong underlying net earnings growth. In addition, our 2017 year-end results include an estimate for the expense associated with U.S. tax reform. We expect an on-going benefit to our tax rate in future periods and will discuss this further at our Toy Fair Investor Event.”

Fourth Quarter 2017 Financial Results

Fourth quarter 2017 net revenues of $1.60 billion compared to $1.63 billion in 2016. 2017 net revenues include a favorable $44.3 million from foreign exchange.

As reported net loss for the fourth quarter 2017 totaled $5.3 million, or $0.04 per diluted share, compared to net earnings of $192.7 million, or $1.52 per diluted share in 2016. Fourth quarter 2017 net earnings include a $0.09 per diluted share benefit versus fourth quarter 2016 from the adoption of FASB ASU No. 2016-09, Improvements to Employee Share-Based Payment Accounting. Adjusted net earnings for the fourth quarter 2017 were $291.2 million, or $2.30 per diluted share, excluding $296.5 million or $2.35 per diluted share, from U.S. tax reform. Adjusted net earnings for the fourth quarter 2016 were $207.4 million, or $1.64 per diluted share, excluding a post-tax $14.7 million, or $0.12 per diluted share, non-cash fourth quarter 2016 goodwill impairment charge related to Backflip Studios.

Full-Year 2017 Major Segment Performance

Net Revenues ($ Millions) Operating Profit ($ Millions)

FY 2017 FY 2016 % Change FY 2017 FY 2016 % Change

U.S. and Canada $2,690.5 $2,559.9 +5% $509.9 $522.3 -2%

International $2,233.6 $2,194.7 +2% $228.7 $294.5 -22%

Entertainment and Licensing $285.6 $265.2 +8% $96.4 $49.9 +93%

Note: Full-year 2016 Entertainment and Licensing segment operating profit includes a pre-tax $32.9 million fourth quarter 2016 non-cash goodwill impairment charge. The impact of that charge is outlined in the attached schedule “Net Earnings and Earnings per Share Excluding the Impact of Tax Reform and Goodwill Impairment.”

Full-year 2017 U.S. and Canada segment net revenues increased 5% to $2.69 billion compared to $2.56 billion in 2016. The U.S. and Canada segment operating profit declined 2% to $509.9 million, or 19.0% of net revenues, compared to $522.3 million, or 20.4% of net revenues in 2016, primarily driven by increased advertising as well as higher bad debt expense related to the Toys“R”Us bankruptcy filing in the third quarter of 2017.

Full-year International segment net revenues increased 2% to $2.23 billion compared to $2.19 billion in 2016. Full-year 2017 International segment revenues include a favorable $75.3 million impact of foreign exchange. On a regional basis, Europe net revenues decreased 2%, Latin America increased 5% and Asia Pacific increased 12%. Emerging markets net revenues increased 5% in the year. International segment operating profit decreased 22% to $228.7 million, or 10.2% of net revenues, compared to $294.5 million, or 13.4% of net revenues in 2016. The decline in operating profit was driven by higher sales allowances and unfavorable product mix, as well as higher advertising costs.

Entertainment and Licensing segment net revenues increased 8% to $285.6 million compared to $265.2 million in 2016. Full-year gains were driven by growth in consumer products and digital gaming, as well as the addition of Boulder Media. Operating profit was $96.4 million, or 33.8% of net revenues, compared to $49.9 million, or 18.8% of net revenues, in 2016. 2016 adjusted operating profit was $82.7 million, or 31.2% of net revenues, excluding a pre-tax $32.9 million non-cash fourth quarter 2016 goodwill impairment charge related to Backflip Studios.

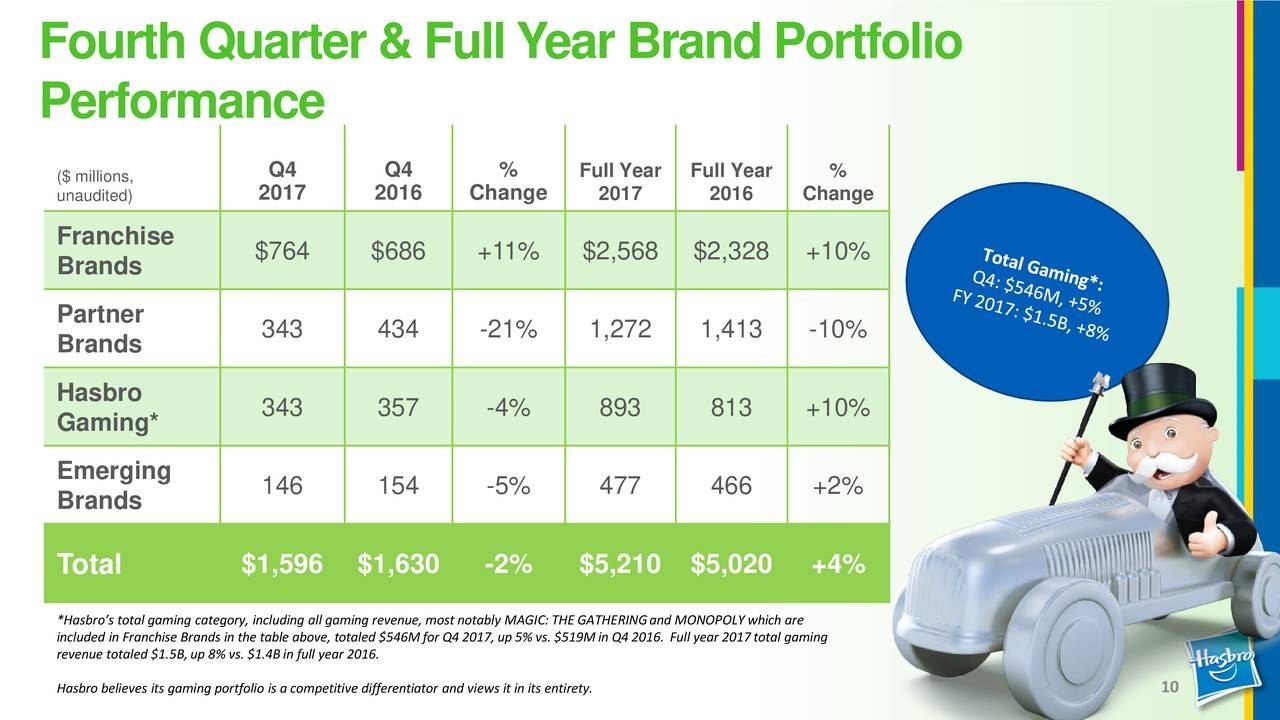

Fourth Quarter and Full-Year 2017 Brand Portfolio Performance

Net Revenues ($ Millions)

Q4 2017 Q4 2016 % Change FY 2017 FY 2016 % Change

Franchise Brands $764.2 $685.6 +11% $2,568.0 $2,327.7 +10%

Partner Brands $342.9 $433.7 -21% $1,271.6 $1,412.8 -10%

Hasbro Gaming* $343.3 $356.9 -4% $893.0 $813.4 +10%

Emerging Brands $145.7 $153.7 -5% $477.2 $466.0 +2%

*Hasbro’s total gaming category, including all gaming revenue, most notably MAGIC: THE GATHERING and MONOPOLY, which are included in Franchise Brands in the table above, totaled $546.4 million for the fourth quarter 2017, up 5%, versus $518.7 million in the fourth quarter 2016 and up 8% to $1,497.8 million for full-year 2017 versus $1,387.1 million for full-year 2016. Hasbro believes its gaming portfolio is a competitive differentiator and views it in its entirety.

Full-year 2017 Franchise Brand net revenues increased 10% to $2.57 billion driven by revenue growth in TRANSFORMERS, NERF, MONOPOLY and MY LITTLE PONY. Franchise Brand revenue grew in all three major operating segments.

Partner Brand net revenues decreased 10% to $1.27 billion. An increase in BEYBLADE, MARVEL and SESAME STREET revenues was more than offset by a revenue decline in STAR WARS and to a lesser extent declines in YO-KAI WATCH and DISNEY FROZEN. Partner Brand revenues decreased in the U.S. and Canada and International segments.

Hasbro Gaming net revenues grew 10% to $893.0 million. Hasbro’s diverse gaming portfolio includes a broad spectrum of gaming experiences from face-to-face gaming, social gaming and digital gaming. New social games, such as SPEAK OUT, TOILET TROUBLE and FANTASTIC GYMNASTICS, were among many which contributed to growth. In addition, several other gaming brands grew, including DUNGEONS & DRAGONS, the launch of DROPMIX and growth in digital gaming. Hasbro Gaming net revenues grew in the U.S. and Canada and International segments. Hasbro’s total gaming category grew 8% to $1.50 billion, including revenue growth from MONOPOLY.

Emerging Brands net revenues increased 2% to $477.2 million, behind strong growth in BABY ALIVE and FURREAL FRIENDS. Emerging Brand net revenues grew in the U.S. and Canada segment.

Dividend and Share Repurchase

The Company paid $277.0 million in cash dividends to shareholders during 2017. Hasbro’s Board of Directors has declared a quarterly cash dividend of $0.63 per common share. This represents an increase of $0.06 per share, or 11%, from the previous quarterly dividend of $0.57 per common share. The dividend will be payable on May 15, 2018 to shareholders of record at the close of business on May 1, 2018.

For the full-year 2017, Hasbro repurchased 1.58 million shares of common stock at a total cost of $150.0 million and an average price of $94.74 per share. At year end, $178.0 million remained available in the current share repurchase authorization.

Conference Call Webcast

Hasbro will webcast its fourth quarter and full-year 2017 earnings conference call at 8:30 a.m. Eastern Time today. To listen to the live webcast and access the accompanying presentation slides, please go to http://investor.hasbro.com. The replay of the call will be available on Hasbro’s web site approximately 2 hours following completion of the call.

About Hasbro

Hasbro (NASDAQ: HAS) is a global play and entertainment company committed to Creating the World's Best Play Experiences. From toys and games to television, movies, digital gaming and consumer products, Hasbro offers a variety of ways for audiences to experience its iconic brands, including NERF, MY LITTLE PONY, TRANSFORMERS, PLAY-DOH, MONOPOLY, LITTLEST PET SHOP and MAGIC: THE GATHERING, as well as premier partner brands. Through Hasbro Studios and its film labels, Allspark Pictures and Allspark Animation, the Company is building its brands globally through great storytelling and content on all screens. Hasbro is committed to making the world a better place for children and their families through corporate social responsibility and philanthropy. Hasbro ranked No. 1 on the 2017 100 Best Corporate Citizens list by CR Magazine, and has been named one of the World’s Most Ethical Companies® by Ethisphere Institute for the past six years. Learn more at www.hasbro.com, and follow us on Twitter (@Hasbro & @HasbroNews) and Instagram (@Hasbro).

© 2018 Hasbro, Inc. All Rights Reserved.

Certain statements in this release contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include expectations concerning the Company’s potential performance in the future and the Company’s ability to achieve its financial and business goals and may be identified by the use of forward-looking words or phrases. The Company's actual actions or results may differ materially from those expected or anticipated in the forward-looking statements due to both known and unknown risks and uncertainties. Specific factors that might cause such a difference include, but are not limited to: (i) the Company's ability to design, develop, produce, manufacture, source and ship products on a timely and cost-effective basis, as well as interest in and purchase of those products by retail customers and consumers in quantities and at prices that will be sufficient to recover the Company’s costs and earn a profit; (ii) downturns in economic conditions impacting one or more of the markets in which the Company sells products, such as the economic downturns which impacted the United Kingdom and Brazil in 2017, which can negatively impact the Company’s retail customers and consumers, and which can result in lower employment levels, lower consumer disposable income, lower retailer inventories and lower spending, including lower spending on purchases of the Company’s products; (iii) other factors which can lower discretionary consumer spending, such as higher costs for fuel and food, drops in the value of homes or other consumer assets, and high levels of consumer debt; (iv) consumer interest in entertainment properties, such as motion pictures, for which the Company is developing and marketing products, and the ability to drive sales of products associated with such entertainment properties, (v) potential difficulties or delays the Company may experience in implementing cost savings and efficiency enhancing initiatives; (vi) other economic and public health conditions or regulatory changes in the markets in which the Company and its customers and suppliers operate which could create delays or increase the Company’s costs, such as higher commodity prices, labor costs or transportation costs, or outbreaks of disease; (vii) currency fluctuations, including movements in foreign exchange rates, which can lower the Company’s net revenues and earnings, and significantly impact the Company’s costs; (viii) the concentration of the Company's customers, potentially increasing the negative impact to the Company of difficulties experienced by any of the Company’s customers or changes in their purchasing or selling patterns; (ix) consumer interest in and acceptance of the Discovery Family Channel, and programming created by Hasbro Studios, and other factors impacting the financial performance of the network and Hasbro Studios; (x) the inventory policies of the Company’s retail customers, including retailers’ potential decisions to lower their inventories, even if it results in lost sales, as well as the concentration of the Company's revenues in the second half and fourth quarter of the year, which coupled with reliance by retailers on quick response inventory management techniques increases the risk of underproduction of popular items, overproduction of less popular items and failure to achieve compressed shipping schedules; (xi) delays, increased costs or difficulties associated with any of our or our partners’ planned digital applications or media initiatives; (xii) work disruptions, which may impact the Company's ability to manufacture or deliver product in a timely and cost-effective manner; (xiii) the bankruptcy or other lack of success of one of the Company's significant retailers, such as the bankruptcy of Toys “R” Us in the United States and Canada in the fourth quarter of 2017, which could negatively impact the Company's revenues or bad debt exposure; (xiv) the impact of competition on revenues, margins and other aspects of the Company's business, including the ability to offer Company products which consumers choose to buy instead of competitive products, the ability to secure, maintain and renew popular licenses and the ability to attract and retain talented employees; (xv) concentration of manufacturing for many of the Company’s products in the People’s Republic of China and the associated impact to the Company of social, economic or public health conditions and other factors affecting China, the movement of products into and out of China, the cost of producing products in China and exporting them to other countries; (xvi) the risk of product recalls or product liability suits and costs associated with product safety regulations; (xvii) the impact of other market conditions, third party actions or approvals and competition which could reduce demand for the Company’s products or delay or increase the cost of implementation of the Company's programs or alter the Company's actions and reduce actual results; (xviii) changes in tax laws or regulations, or the interpretation and application of such laws and regulations, such as what may occur as the U.S. Tax Cuts and Jobs Act is interpreted and applied, which may cause the Company to alter tax reserves or make other changes which significantly impact its reported financial results; (xix) the impact of litigation or arbitration decisions or settlement actions; and (xx) other risks and uncertainties as may be detailed from time to time in the Company's public announcements and Securities and Exchange Commission (“SEC”) filings. The Company undertakes no obligation to make any revisions to the forward-looking statements contained in this release or to update them to reflect events or circumstances occurring after the date of this release.

This press release includes non-GAAP financial measures as defined under SEC rules, specifically Adjusted net earnings and earnings per share, excluding the impact of U.S. tax reform in 2017 and the impact of a goodwill impairment charge associated with Backflip Studios in 2016, as well as adjusted operating profit absent the impact of the goodwill impairment charge. Also included in the financial tables attached to this release are the non-GAAP financial measures of EBITDA and Adjusted EBITDA. EBITDA represents net earnings attributable to Hasbro, Inc. excluding net loss attributable to noncontrolling interests, interest expense, income taxes, depreciation and amortization. Adjusted EBITDA also excludes the impact of re-measuring a liability as a result of U.S. tax reform in 2017 and the impact of a goodwill impairment charge in 2016. As required by SEC rules, we have provided reconciliation on the attached schedule of these measures to the most directly comparable GAAP measure. Management believes that Adjusted net earnings, Adjusted earnings per share and adjusted operating profit absent the impact of U.S. tax reform and the goodwill impairment charge provides investors with an understanding of the underlying performance of the Company’s business absent these unusual events. Management believes that EBITDA and Adjusted EBITDA are appropriate measures for evaluating the operating performance of the Company because they reflect the resources available for strategic opportunities including, among others, to invest in the business, strengthen the balance sheet and make strategic acquisitions. These non-GAAP measures should be considered in addition to, not as a substitute for, or superior to, net earnings or other measures of financial performance prepared in accordance with GAAP as more fully discussed in the Company's financial statements and filings with the SEC. As used herein, "GAAP" refers to accounting principles generally accepted in the United States of America.

HAS-E

1 According to NPD and SIM

Discuss This Topic · Permanent Link

Views: 13,939

Discuss This Topic · Permanent Link

Views: 22,378

Discuss This Topic · Permanent Link

Views: 33,594

WE'RE HIRING!! Boulder Media, in partnership with Hasbro, are looking for animation professionals for the first CG feature film to be made in Ireland. Join us for a drink and a chat in a city near you. See you there.

Discuss This Topic · Permanent Link

Views: 17,866

Ian Dawson was further on the record of saying that:"We've had a few delays, as often happens with a new team, new car, new infrastructure," said Ian Dawson. "Although we would love to commence the season at the Rolex 24 At Daytona, it is also one of the most grueling races in the world. We decided that rather than rush with a new car not yet tested, new drivers, new team, to try to make the Roar Before the 24 test days at Daytona the first week of January and then the race just over two weeks later, we would delay our race start."

"We would like to do a proper testing program in the U.S. with our new Onroak Ligier Gibson LMP2 in January and February, and go into the 12 Hours of Sebring in March with a solid team structure," Dawson added. "This will also allow us to finalize further details with our core partners and best be able to enter the season in a position of strength."

Goto Page: << 1, 2, 3, 4, 5, 6

60 total news articles in this section, 10 per page.

News Archives: 2024, 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009, 2008, 2007, 2006, 2005, 2004, 2003, 2002, 2001

News Categories: View All Categories, Toy News, Movie Related News, Cartoon News, Comic Book News, Site News, Rumors, Event News, Digital Media News, Collectables, Sponsor News, Game News, Site Articles, Store News, Reviews, People News, Company News, Sightings, Press Releases, Unlicensed Products News, Auctions, Transtopia, Interviews, Editorials, Collector's Club News, Knock Offs, Podcast, Heavy Metal War, Contests, Book News, Top Lists