Transformers and More @ The Seibertron Store

Burn wrote:But yeah ... let's leave political leanings out of this and stick to facts.

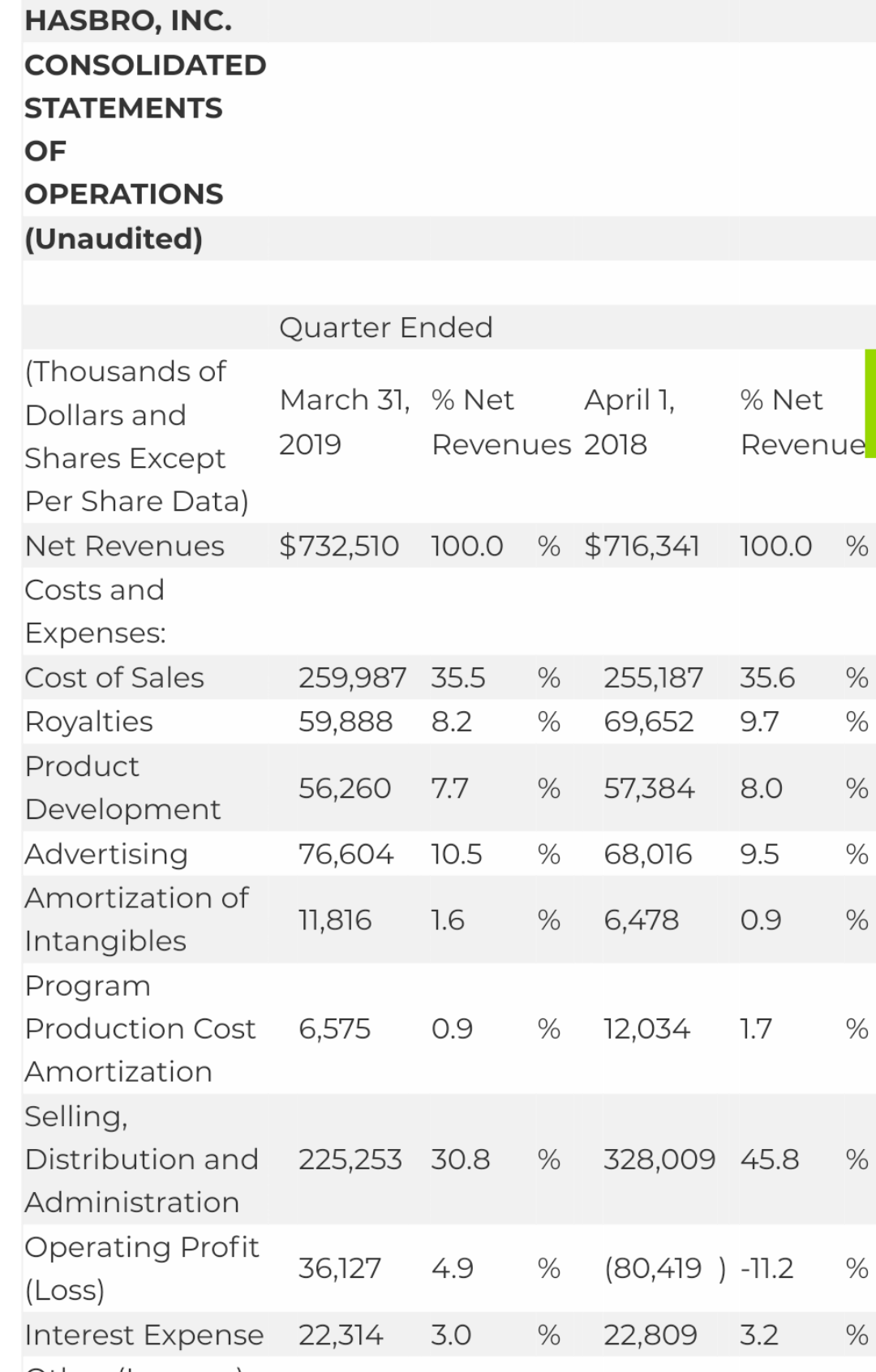

First quarter 2019 revenues increased 2% to $732.5 million; Absent a negative $24.3 million impact of foreign exchange, first quarter 2019 revenues grew 6%

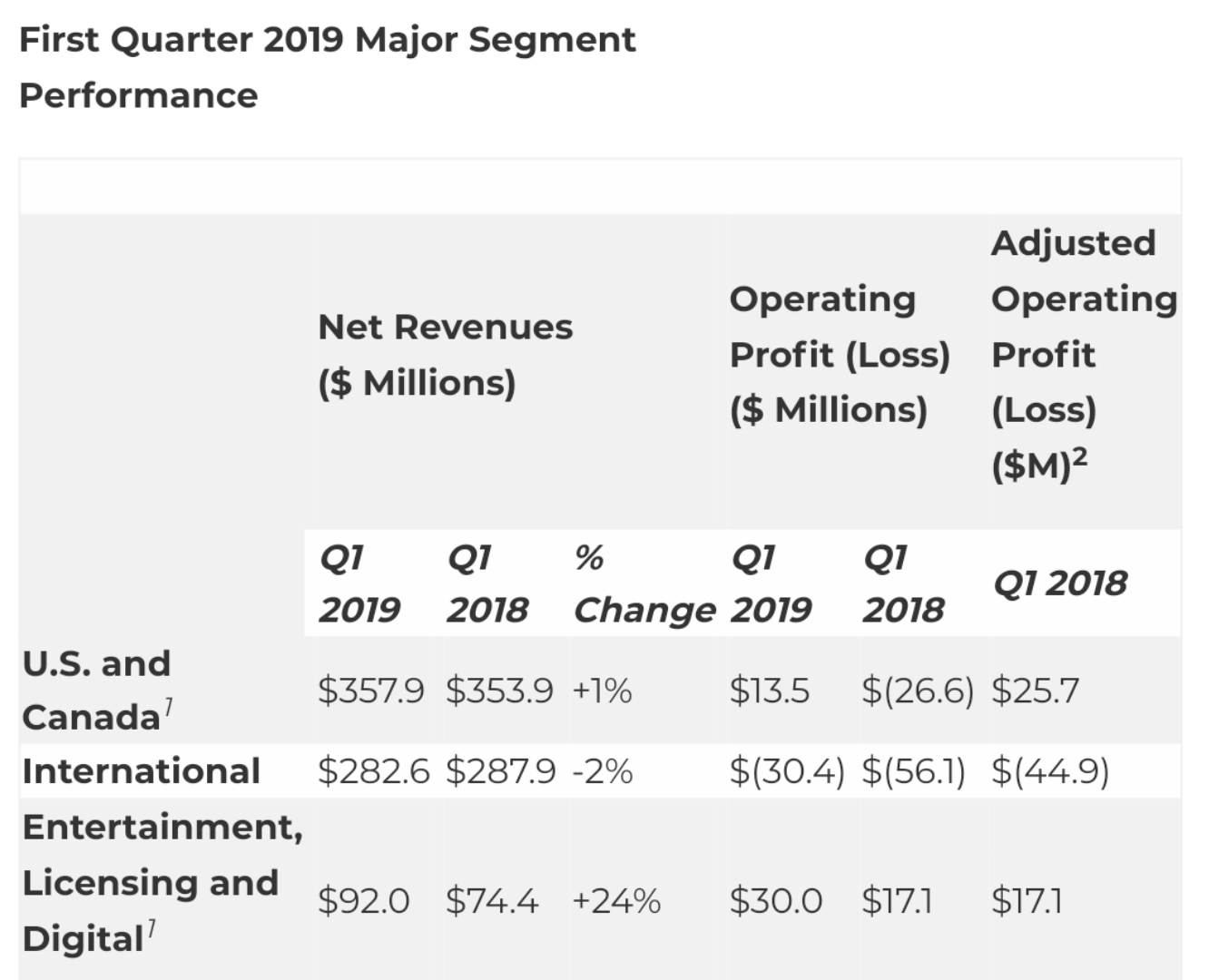

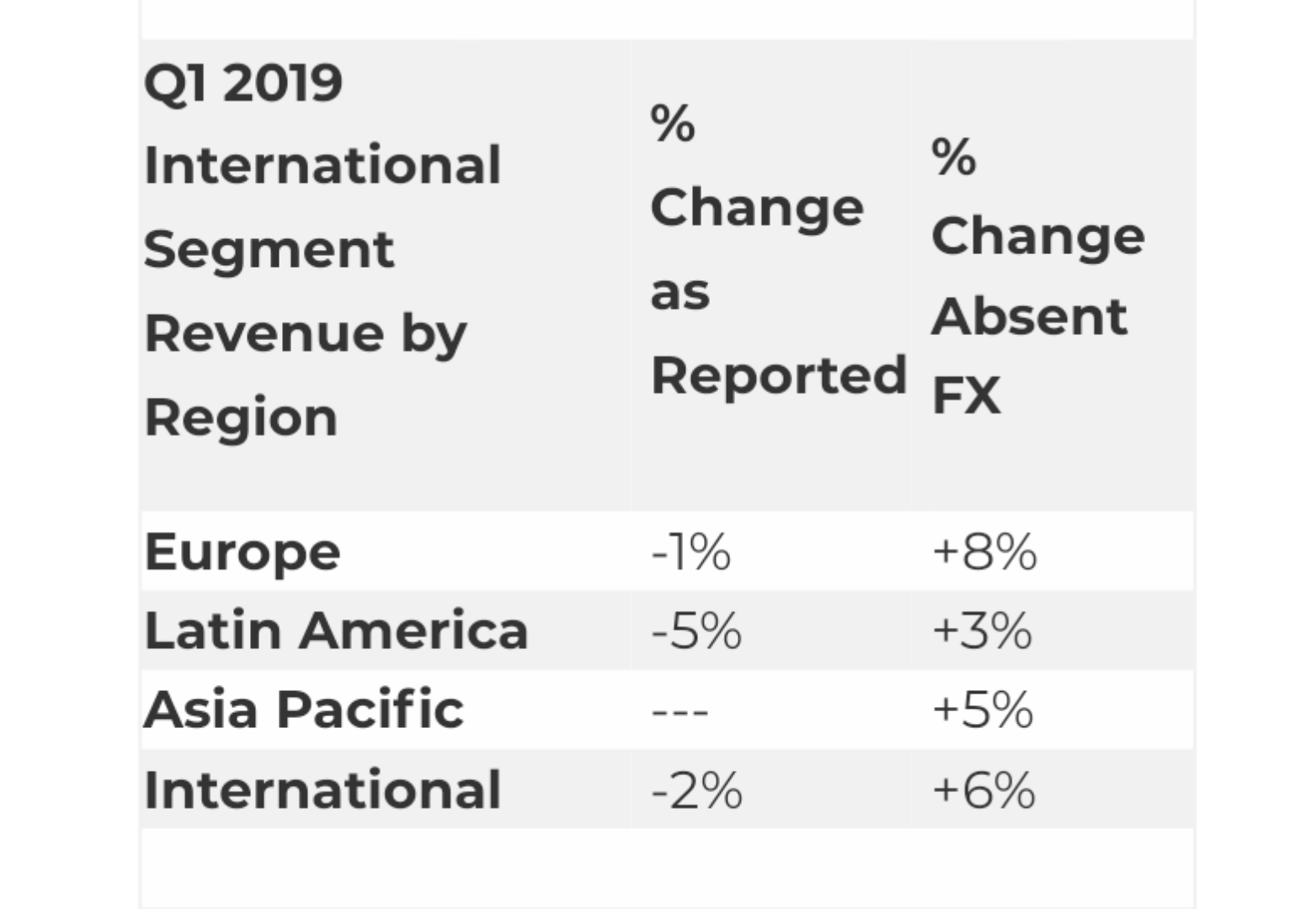

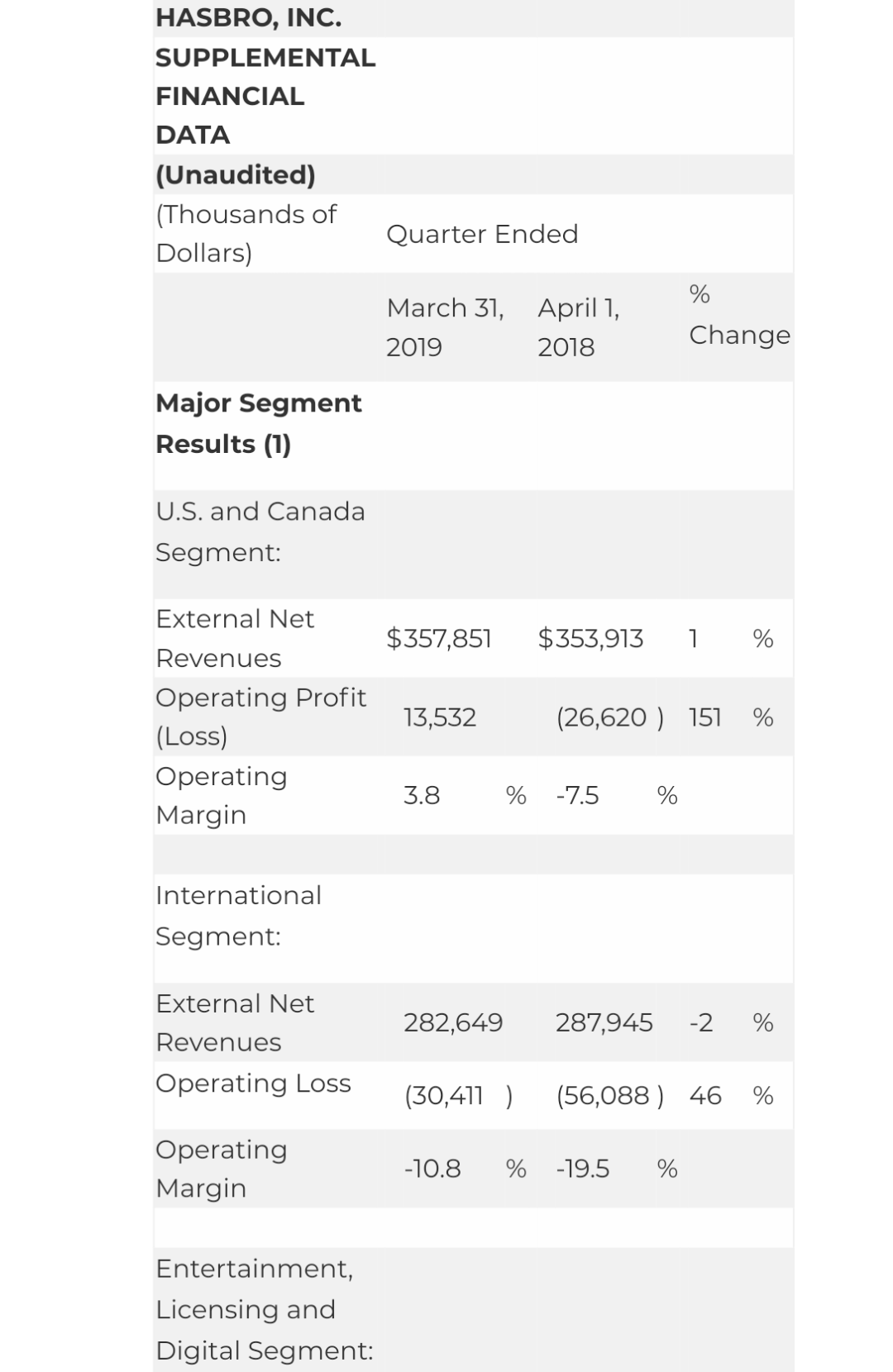

Revenues increased 1% in the U.S. and Canada segment and 24% in the Entertainment, Licensing and Digital segment; International segment revenues declined 2%, but increased 6% absent a negative $23.4 million impact of foreign exchange

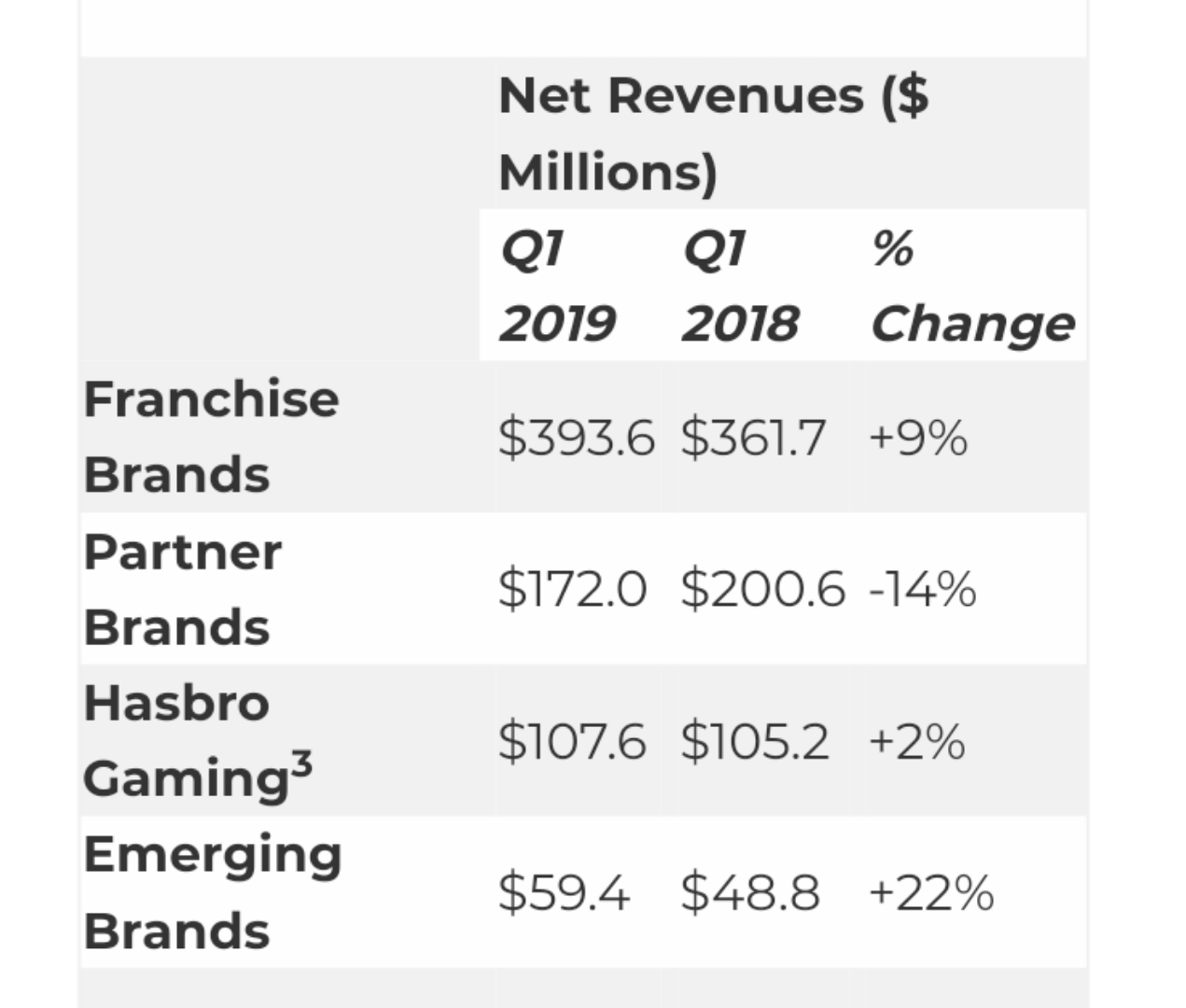

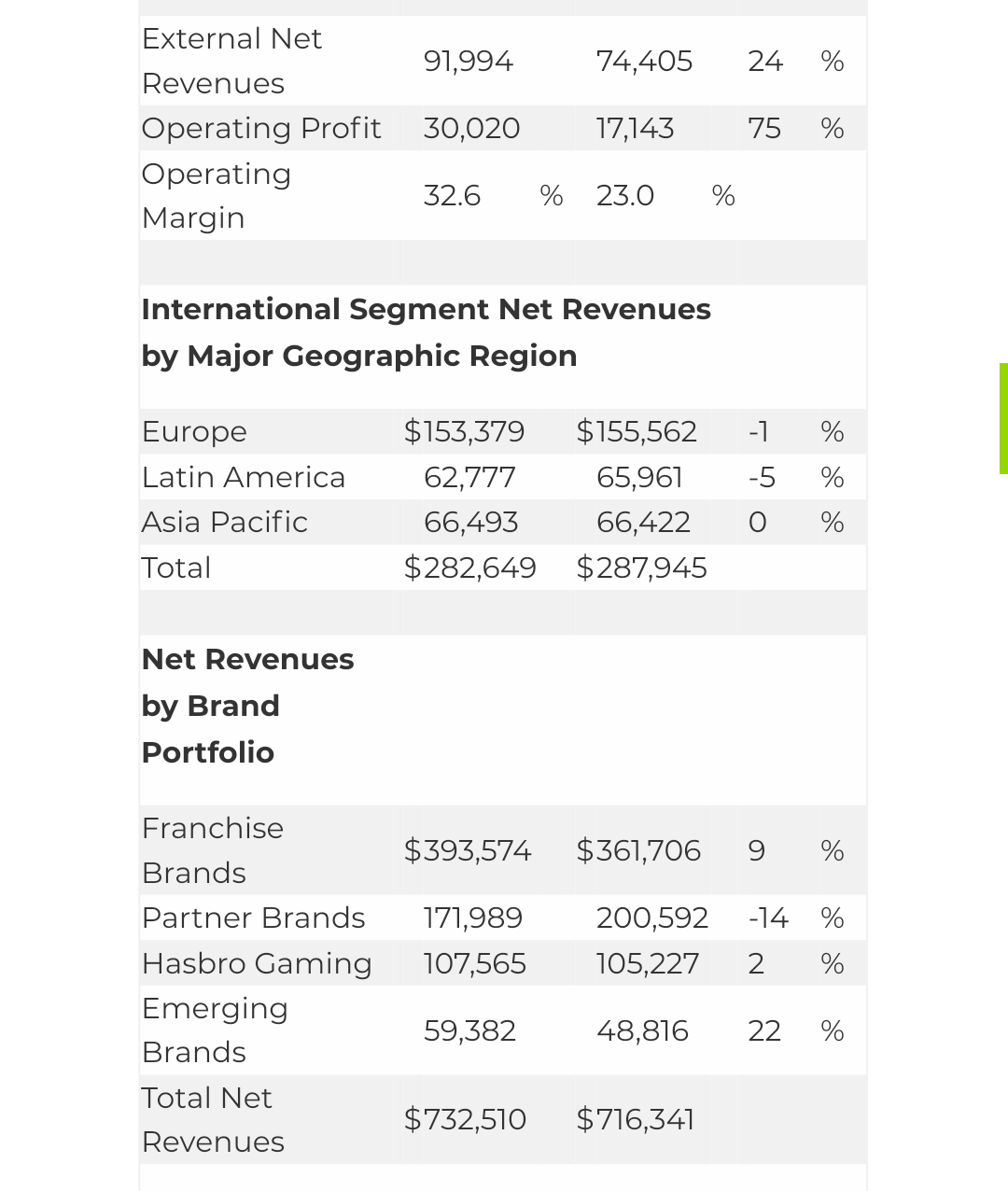

Franchise Brands revenue increased 9%; Hasbro Gaming up 2%; Emerging Brands up 22%; and Partner Brand revenues declined 14%

Operating profit increased to $36.1 million or 4.9% of revenues

Net earnings increased to $26.7 million or $0.21 per diluted share

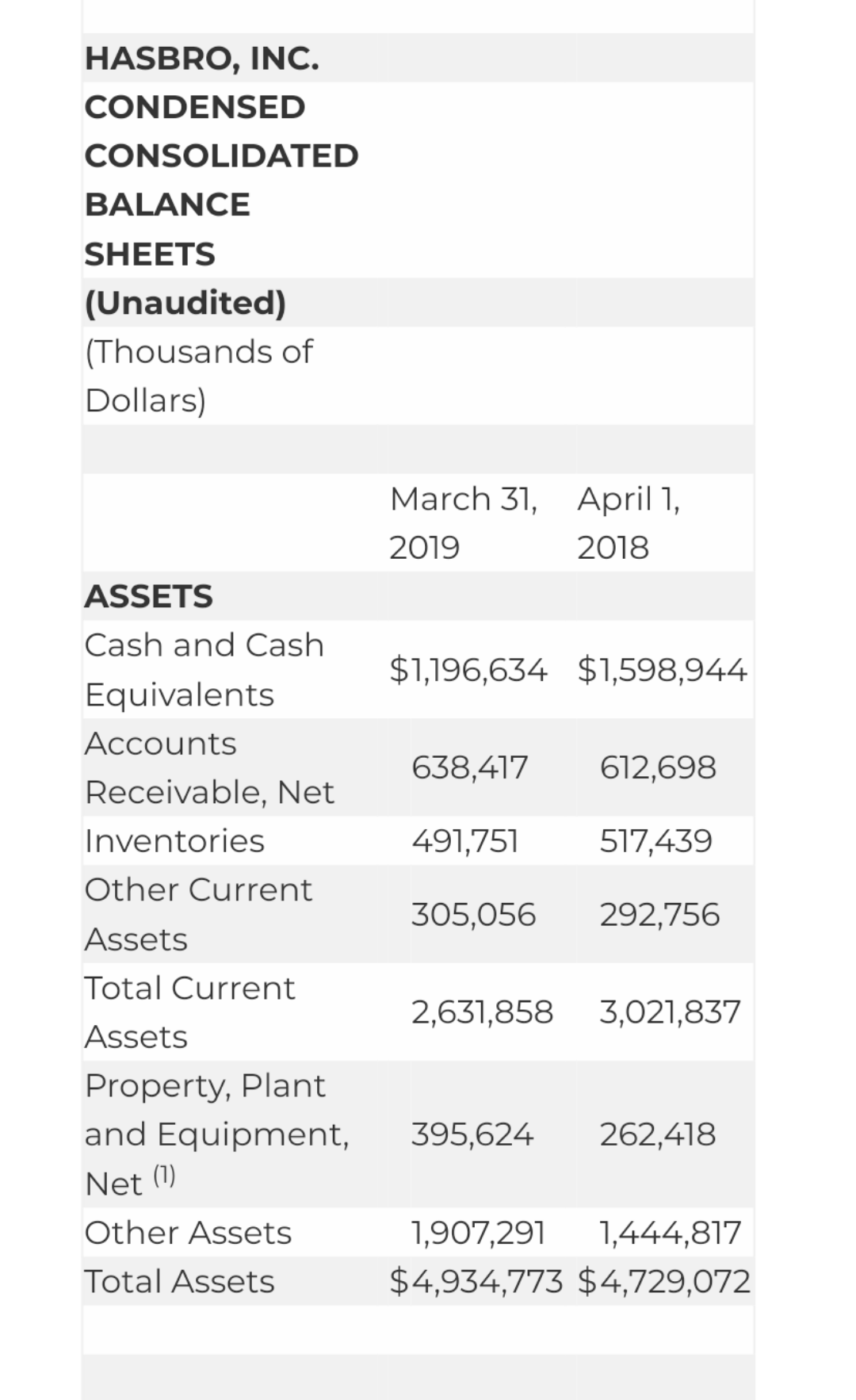

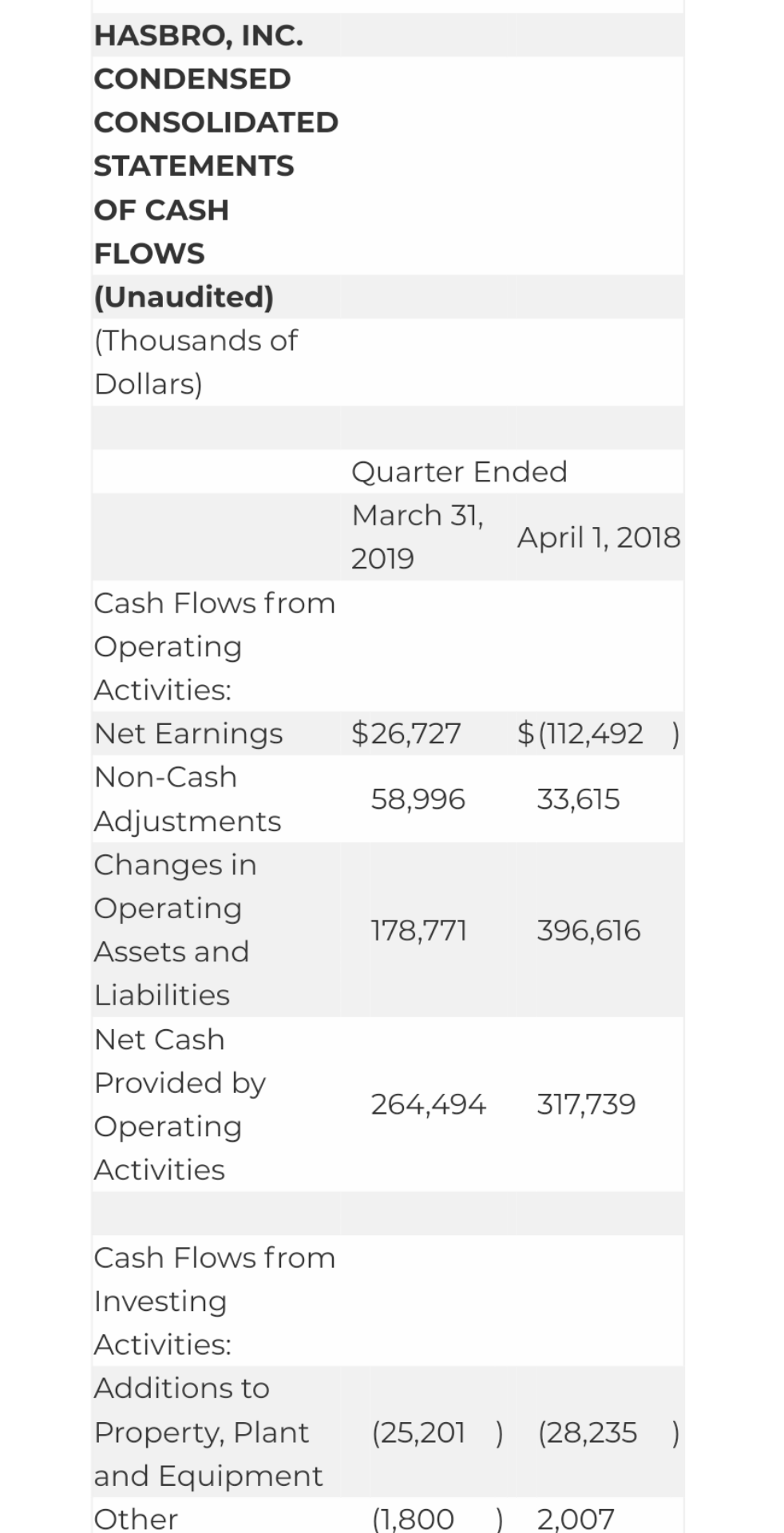

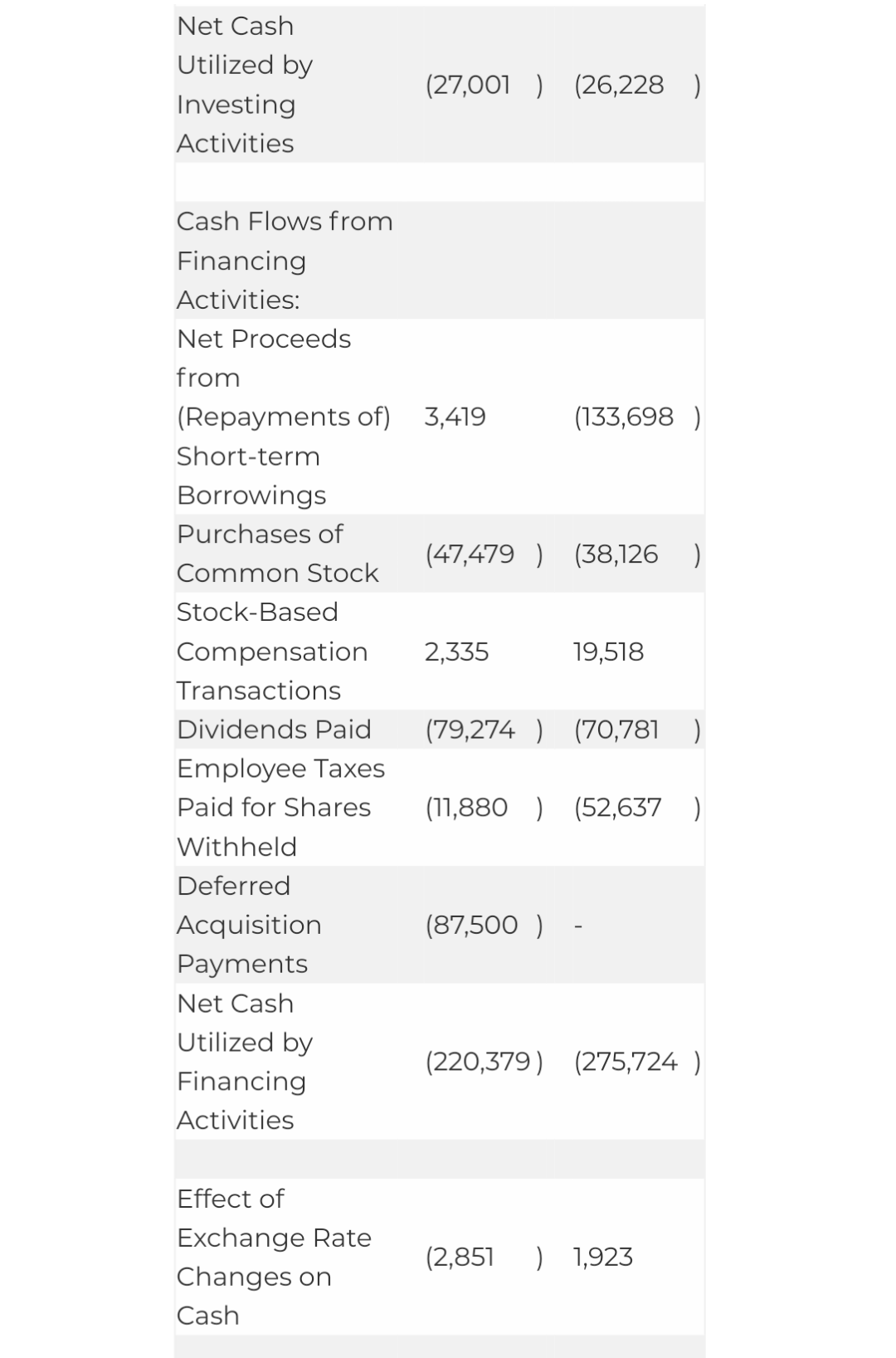

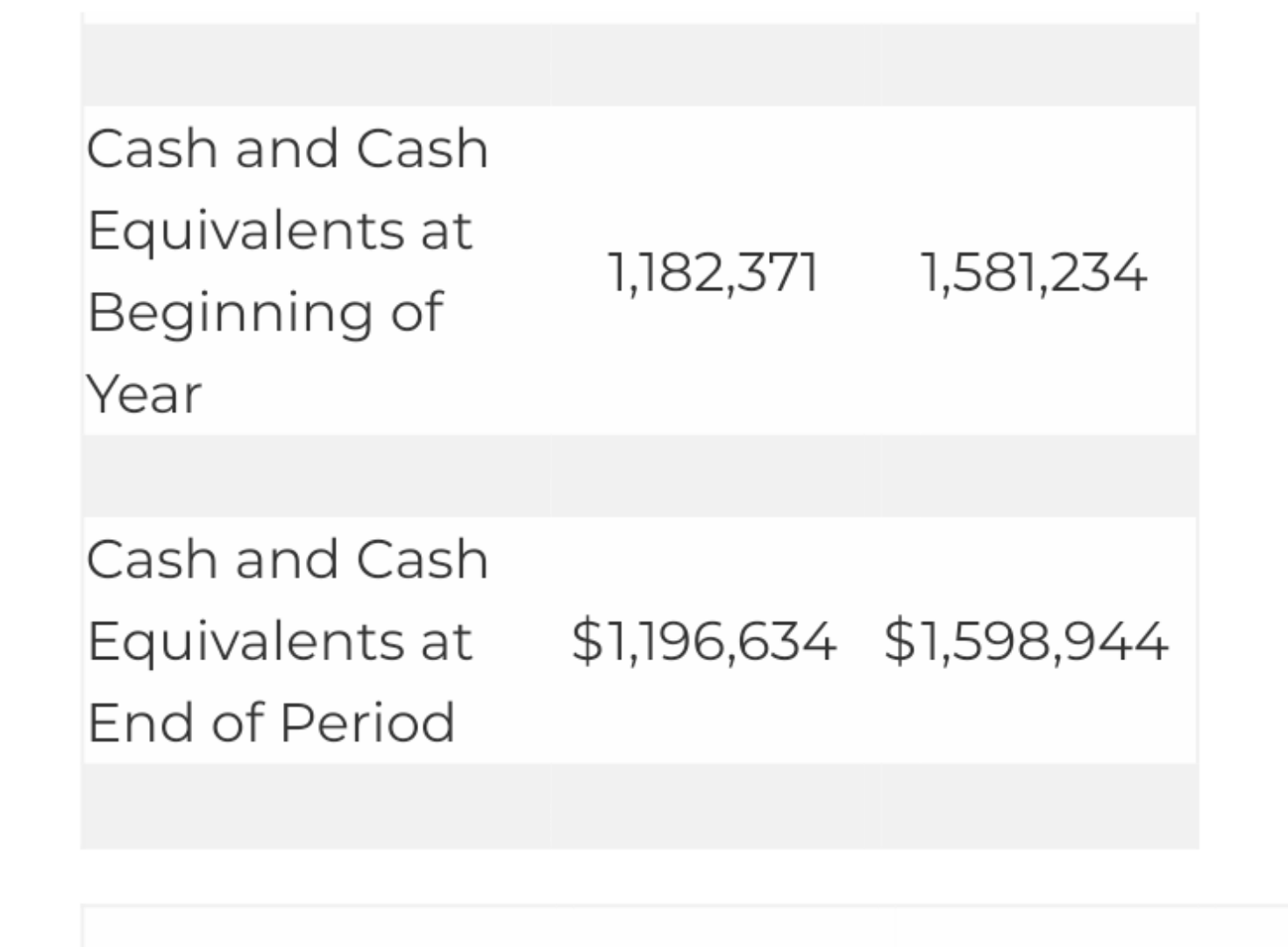

Quarter ending cash of $1.2 billion; Returned $128.5 million to shareholders including $79.3 million in cash dividends and $49.2 million in share repurchases

Hasbro, Inc. (NASDAQ: HAS) today reported financial results for the first quarter 2019. Net revenues for the first quarter 2019 increased 2% to $732.5 million compared to $716.3 million in 2018. Absent a negative $24.3 million impact of foreign exchange, first quarter 2019 revenues grew 6%.

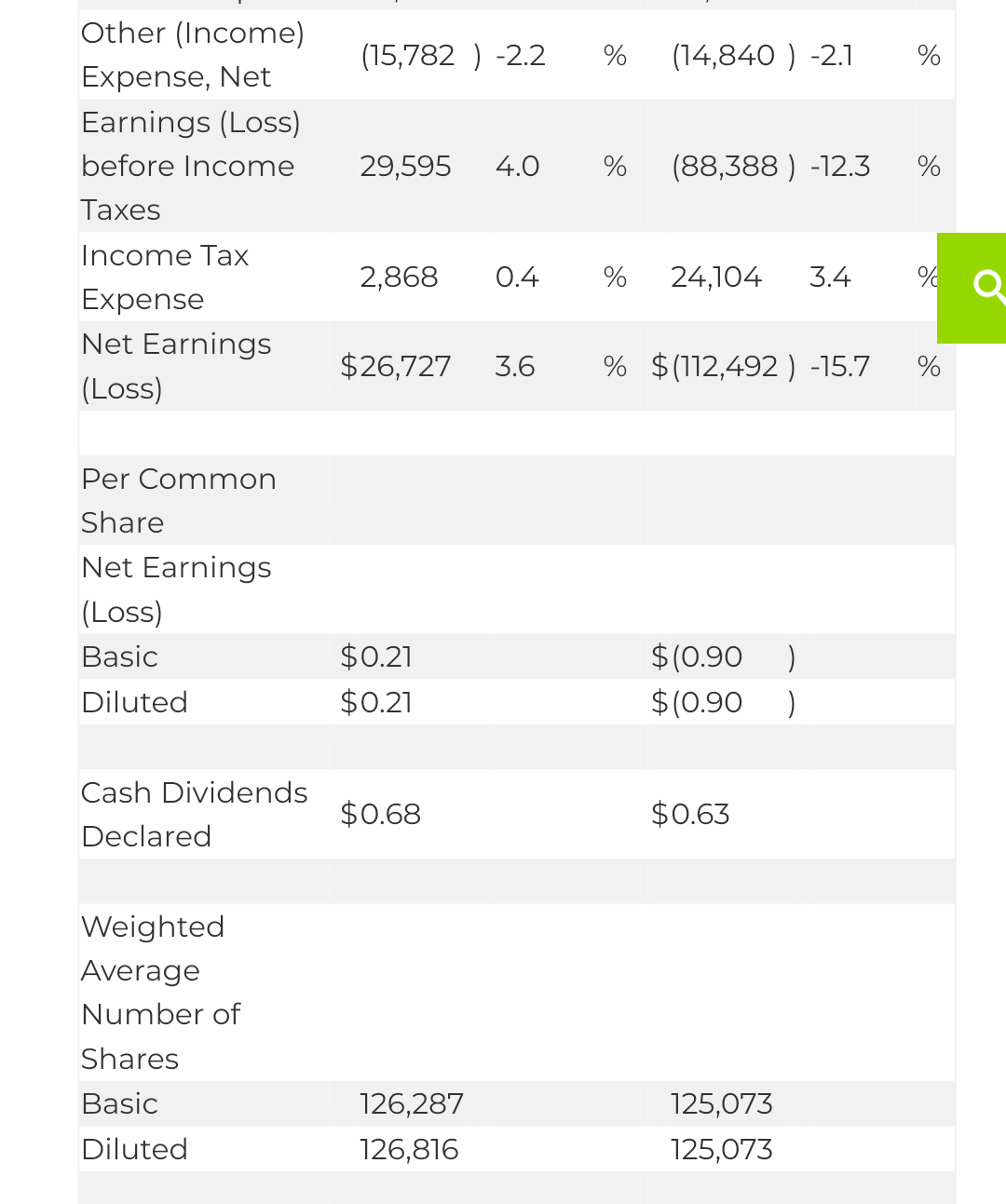

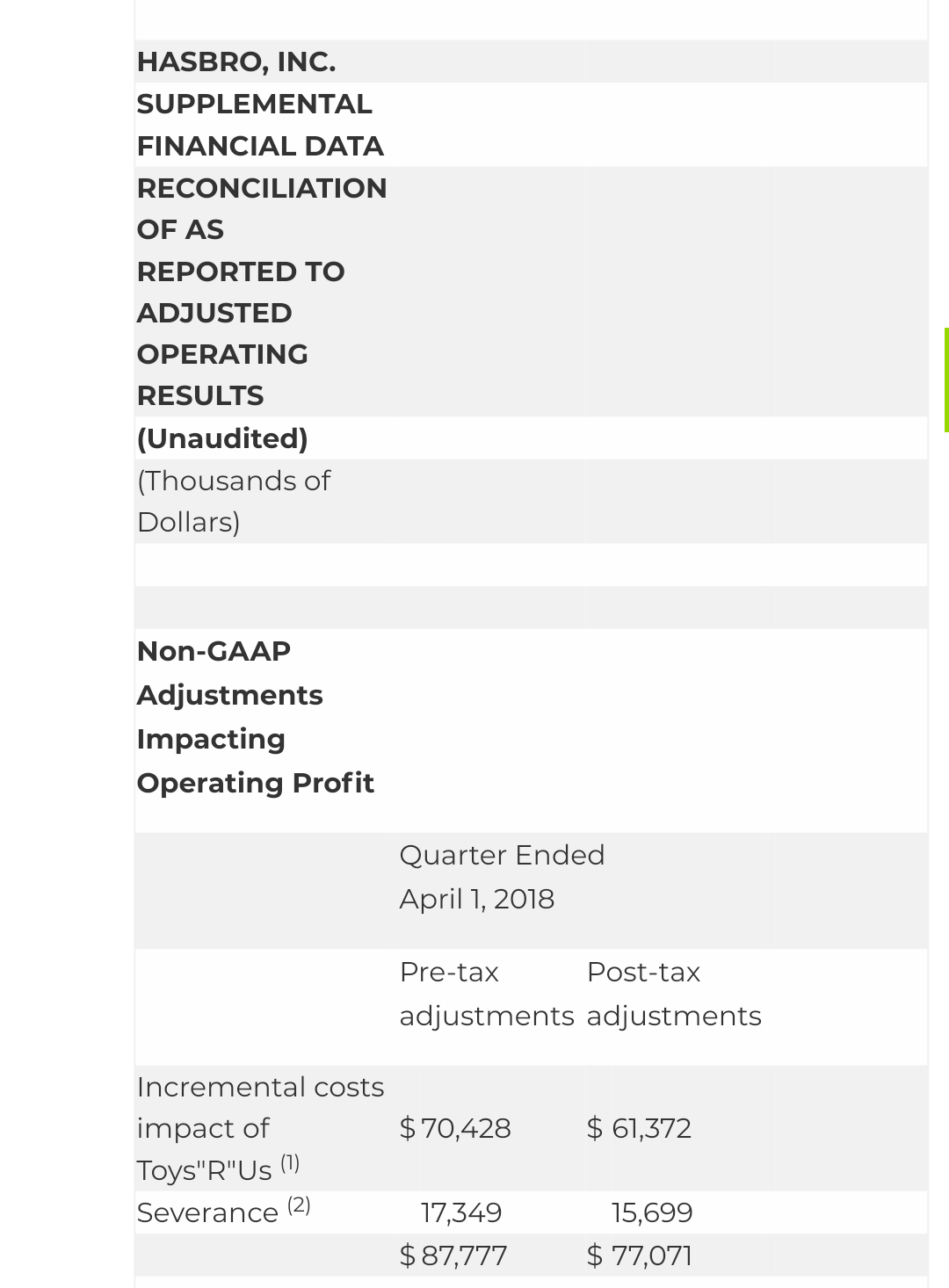

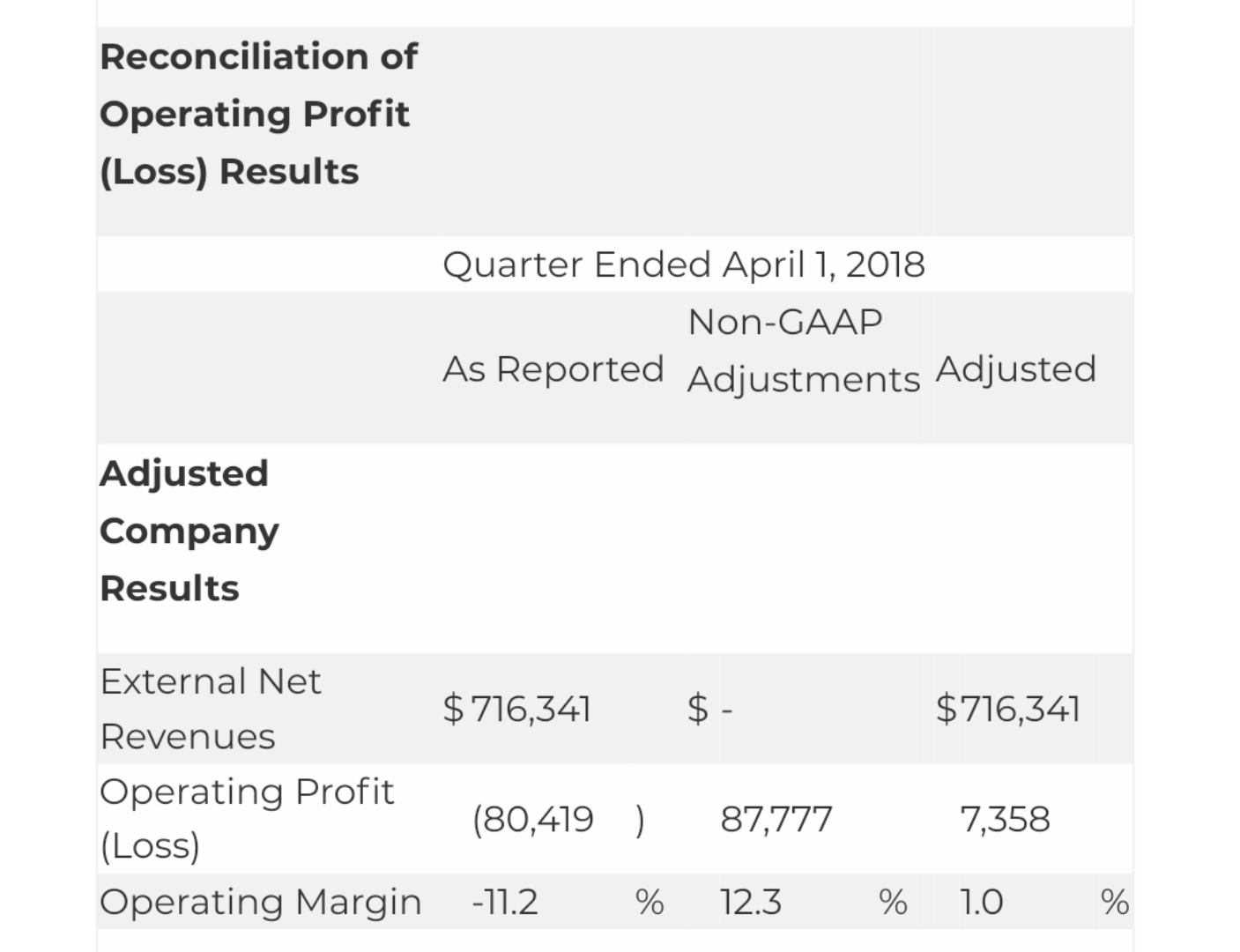

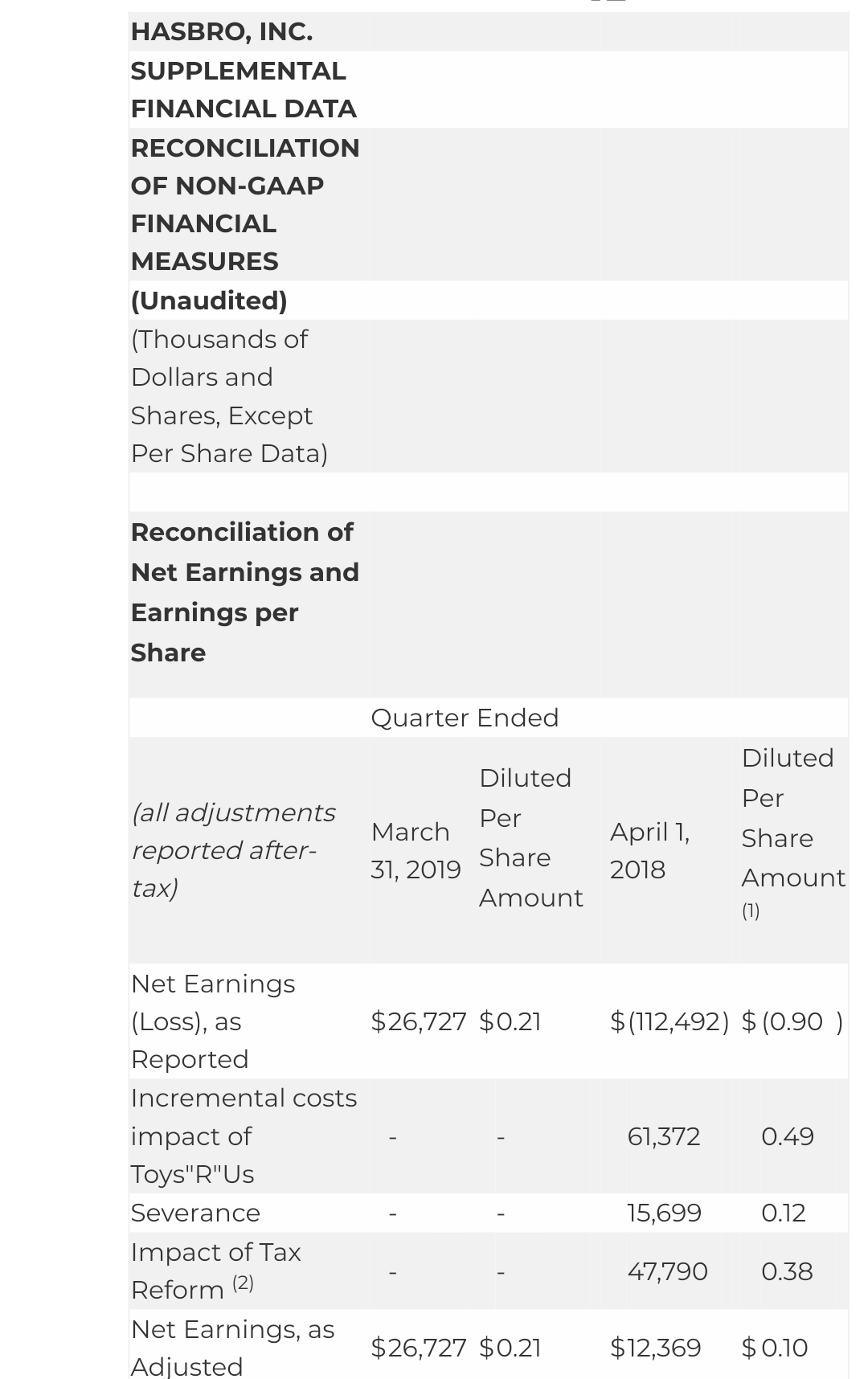

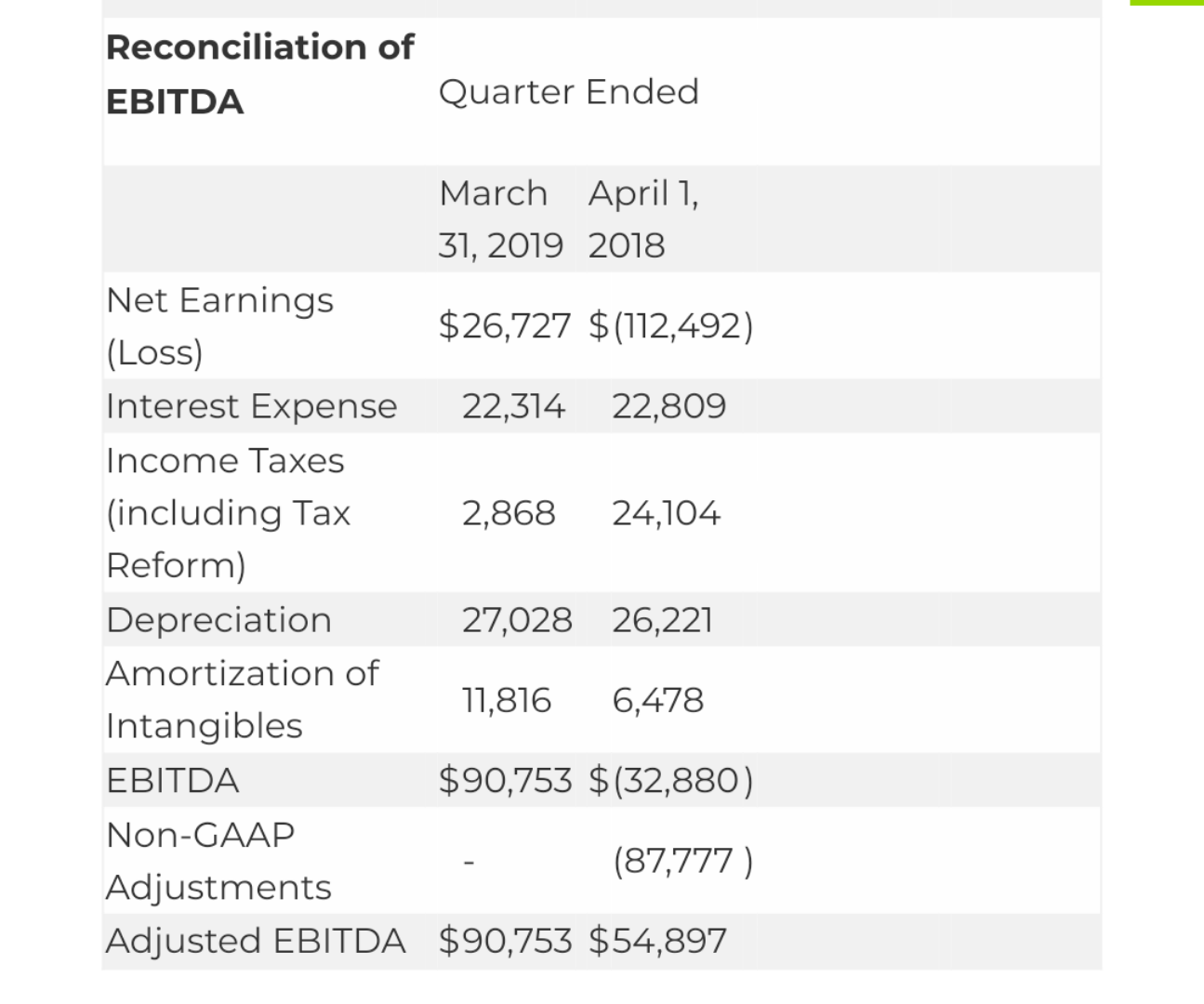

Net earnings for the first quarter were $26.7 million, or $0.21 per diluted share, versus a net loss for the first quarter 2018 of $112.5 million, or $0.90 per diluted share. The 2018 reported net loss includes after-tax expenses of $61.4 million, primarily bad debt, associated with Toys“R”Us; $15.7 million of severance costs associated with the Company’s commercial organization transformation; and a net charge of $47.8 million related to U.S. tax reform (the “Non-GAAP Adjustments”). Excluding the Non-GAAP Adjustments, adjusted net earnings for the first quarter 2018 were $12.4 million or $0.10 per diluted share.

“The global Hasbro team is executing very well and delivered a good start to the year,” said Brian Goldner, Hasbro’s chairman and chief executive officer. “Our long-term investments in new platforms provided a meaningful contribution from our digital and e-sports initiative, Magic: The Gathering Arena, as well as growth in MAGIC: THE GATHERING tabletop revenues. In addition, MONOPOLY, PLAY-DOH and TRANSFORMERS were among the brands posting revenue gains this quarter. We are beginning to see improvement in our commercial markets, notably in the U.S. and Europe, and operating profit was driven by high margin revenue growth and our cost savings activities. With most of the year ahead of us, we remain on track to deliver profitable growth for the full-year 2019.”

“In addition to executing on the top-line, our team remains focused on implementing the cost savings initiatives we announced last year,” said Deborah Thomas, Hasbro’s chief financial officer. “We continue to expect full-year net cost savings of $50-$55 million, as we announced in February. Our balance sheet is strong and we continue investing in areas intended to drive long-term profitable growth.”

The Entertainment and Licensing segment is now the Entertainment, Licensing and Digital segment. For the quarter ended April 1, 2018, Wizards of the Coast digital gaming revenues of $10.4 million, and operating profit of $3.2 million, were reclassified from the U.S. and Canada Segment to the Entertainment, Licensing and Digital segment. The full-year 2018 revenue reclassification is expected to be approximately $58 million.

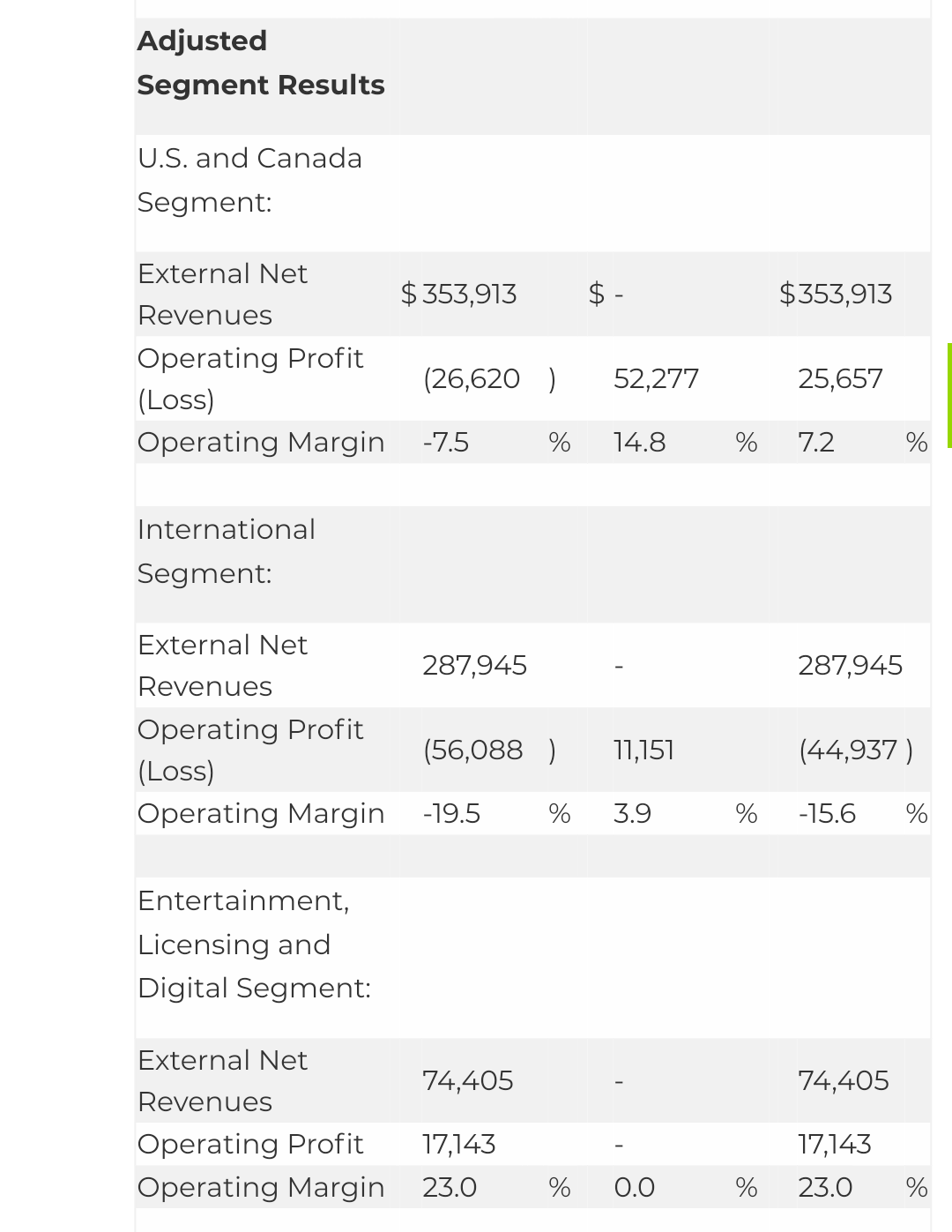

2Please see the attached table, Supplemental Financial Data Reconciliation of As Reported to Adjusted Operating Results, for a reconciliation of as reported to adjusted operating profit.

First quarter 2019 U.S. and Canada segment net revenues increased 1% to $357.9 million compared to $353.9 million in 2018. Revenue growth in Franchise Brands, Hasbro Gaming and Emerging Brands was partially offset by a decline in Partner Brands. The segment reported operating profit of $13.5 million versus an operating loss of $26.6 million and an adjusted operating profit of $25.7 million in 2018. The segment’s operating profit in 2019 was adversely impacted by product mix, higher intangible amortization associated with the POWER RANGERS acquisition and start-up expenses associated with a new Midwest U.S. warehouse.

International segment net revenues for the first quarter 2019 declined 2% to $282.6 million compared to $287.9 million in 2018. Excluding a negative $23.4 million impact of foreign exchange, International segment revenues increased 6%.

International segment revenue growth in Hasbro Gaming and Emerging Brands was more than offset by a decline in Partner Brands. Franchise Brands revenue was flat to a year ago. Absent foreign exchange, Franchise Brands revenue grew in the quarter. The International segment reported an operating loss of $30.4 million compared to an operating loss of $56.1 million and an adjusted operating loss of $44.9 million in 2018. Higher sales volume, cost savings, lower royalties and favorable cost translation rates, all partially offset by higher intangible amortization, drove the improvement in operating profit for the segment.

Entertainment, Licensing and Digital segment net revenues increased 24% to $92.0 million compared to $74.4 million in 2018. Revenue growth was driven by Magic: The Gathering Arena and consumer products licensing revenue. Operating profit increased 75% to $30.0 million, or 32.6% of net revenues, versus $17.1 million, or 23.0% of net revenues in 2018. Operating profit gains were driven by higher revenues and lower program production amortization, partially offset by investments in advertising and product development for MAGIC: THE GATHERING digital gaming initiatives.

Hasbro’s total gaming category, including all gaming revenue, most notably MAGIC: THE GATHERING and MONOPOLY, which are included in Franchise Brands in the table above, totaled $243.4 million for the first quarter 2019, up 20%, versus $203.5 million for the first quarter 2018. Hasbro believes its gaming portfolio is a competitive differentiator and views it in its entirety.

Franchise Brands revenue increased 9% to $393.6 million. MAGIC: THE GATHERING, MONOPOLY, PLAY-DOH and TRANSFORMERS revenues increased in the quarter. Franchise Brands revenue grew in the U.S. and Canada and Entertainment, Licensing and Digital segments, and were flat in the International segment.

Partner Brand revenues declined 14% to $172.0 million. Revenue growth continued in BEYBLADE and we had initial shipments of UGLYDOLLS. These revenue gains were more than offset by declines in several other brands, based on the timing of new entertainment initiatives coming into the market this year. Partner Brand revenues declined in the U.S. and Canada and International segments.

Hasbro Gaming revenue increased 2% to $107.6 million. DUEL MASTERS, CONNECT 4 and TWISTER were among the games contributing to revenue growth for the category. Hasbro Gaming revenues increased in the U.S. and Canada and International segments, but declined in the Entertainment, Licensing and Digital segment. Hasbro’s total gaming category increased 20% to $243.4 million.

Emerging Brands revenue increased 22% to $59.4 million behind revenue for quick strike collectibles, revenue growth in SUPERSOAKER and FURREAL FRIENDS and initial shipments of POWER RANGERS in North America. Emerging Brands revenue grew in the U.S. and Canada and International segments, but declined in the Entertainment, Licensing and Digital segment.

Dividend and Share Repurchase

The Company paid $79.3 million in cash dividends to shareholders during the first quarter 2019. The next quarterly cash dividend payment of $0.68 per common share is scheduled for May 15, 2019 to shareholders of record at the close of business on May 1, 2019.

During the first quarter, Hasbro repurchased 579,174 shares of common stock at a total cost of $49.2 million and an average price of $84.90 per share. At quarter-end, $378.8 million remained available in the current share repurchase authorization.

Return to Transformers General Discussion

Registered users: Bing [Bot], Bumblevivisector, chosenprime, Google [Bot], Google Adsense [Bot], Grahf_, Majestic-12 [Bot], MSN [Bot], Nemesis Primal, Nisus, Perceptor1996, Razama, Razorbeast88, Roadbuster, TF-fan kev777